Well, this was fun while it lasted. Now what did it mean?

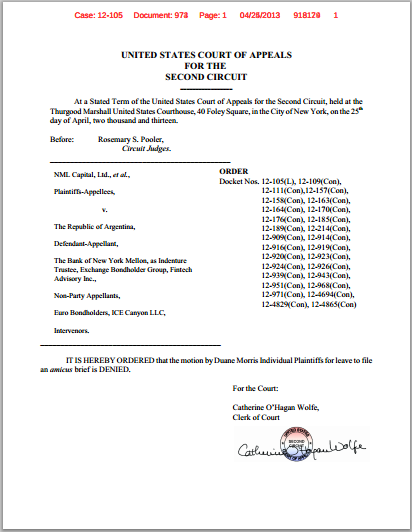

Click to enlarge the document capping a weird week in the pari passu saga:

It’s an order from the Second Circuit on Thursday, denying an unusual request filed on Monday by the Italian retail investors who count themselves among Argentina’s holdouts.

Although looking back at it, was the unusual or just ahead of the curve?

These “Duane Morris” bondholders aren’t among the actual plaintiffs in the pari passu saga. Individuals in this group have already sought judgments on defaulted Argentine debt in other cases. (NML wants injunctive relief, remember.) Taken as a group, the Italian bondholders aren’t known for using US courts as their main forum: that would be ICSID, the World Bank’s investment arbitration tribunal. Indeed there was a time, not so long ago, when the Abaclat case looked like it might rival Elliott’s litigation for finally getting Argentina to cough up. Until Elliott’s pari passu spadework started paying off.

Anyway, Duane Morris still sought to give their two cents on Argentina’s court-ordered proposal for repaying the (past-due) holdout bonds “at issue in this litigation”.

Two cents, in order to get a lot more than 100 cents back on the dollar, it seems:

Retroactively, the only sensible resolution is a lump-sum payment of all interest and principal that has accrued and become due and payable in eleven years to all the current holders of the holdout bonds…

Emphasis in original. And that is where this week’s troubles began.

You can read what happened next in Anna Gelpern’s excellent series of posts hereand here. This particular post of Anna’s — appearing before the Duane Morris holders filed the amicus request — already got to the heart of it. And it is worth expanding upon.

Tom, Dick, and Dirty Harry

It’s the first time in the actual legal briefs of this saga that a fairly straight line has been drawn between the idea of ratable payment on sovereign bonds, and the idea of bondholders suing each other over sharing out the receipt of those payments.

Essentially, creditor A should be allowed to sue creditor B for her share of the pie, if the sovereign’s ratable payment goes only to creditor B and not A.

This is the Tom, Dick, and Harry problem. Generally, it’s been seen either as the path to the Dark Side of the Force and/or endless litigation (not just over Argentina), or as the logical view of the kind of pari passu clause which Argentina’s defaulted bonds possess.

Technically, the problem has come up in the saga before, as the theory that NML and other plaintiffs could sue the restructured holders, if the latter took part in a swap of their debt to help Argentina avoid the injunction. But that wasn’t such a straight line. (For a start, the suits might apply to the likes of Bank of New York first. And this is all theory.)

Anyway — arguably, when it came to this week’s pari passu playground politics, NML started it.

Of course, NML came down like a ton of bricks on the Duane Morris filing. This was amusing in that the Duane Morris filing is, on the substance, more or less a carbon copy of what NML had argued about Argentina’s proposal. Same indignation (perhapsless florid), same arguments (more or less cogent) that the plan fillets the original bonds of past due interest through valuation trickery.

So, NML’s beef was procedural:

We note that the Duane Morris Individual Bondholders refer to themselves as “plaintiffs.” They are not plaintiffs in this action… this Court’s March 1 Order directed Argentina to state what it is prepared to pay Appellees specifically, not what it is willing to pay adversaries in other cases… granting the Duane Morris Individual Bondholders’ motion would surely draw a forest’s worth of proposed amicus filings… opens the door to a fusillade of unnecessary and inappropriate briefing…

This is not mere plaintiff snobbery — the argument was that Argentina would benefit from further delays. (The court’s quick dismissal of the Duane Morris request helps there.)

Still. NML didn’t talk about this part of their own response to Argentina:

Accordingly, the only amount Argentina would pay as a result of this Court affirming the district court’s Injunction is $1.47 billion, which is a mere fraction of what Argentina paid to the Exchange Bondholders in December 2012 alone. If holders of other defaulted indebtedness later bring equal treatment claims of their own, Argentina will have ample opportunity both to litigate the merits (taking into account any factors that may distinguish those bonds from the ones at issue here, including different contractual language and governing law) and to make a showing of financial need, based on circumstances then prevailing, for the district court to consider in shaping a remedy.

Emphasis ours. This was new — and interesting, especially if “other defaulted indebtedness” includes the same “FAA” bonds held by NML and the plaintiffs, and therefore the same pari passu language. Which is what the Duane Morris non-plaintiffs hold.

Holdouts versus holdouts

In that case, contrast the suggestion that these bondholders rely on Argentina’s future “showing of financial need” with their sudden call for the full repayment of “allthe current holders of the holdout bonds”.

That would inflate NML’s “only $1.47bn” to something closer to perhaps $15bn of pari passu claims also knocking on the Republic’s door. This is the pari passu saga, not the plunging peso saga, but when it comes to “circumstances then prevailing”, it’s firstlynot hard to miss what’s been happening to central bank reserves.

Secondly, it’s possibly a danger to the actual plaintiffs. Although NML is only talking about other holders one day suing Argentina, and the Duane Morris proposed amicus brief is aimed at Argentina, the people to sue over the less than full payment of the $15bn or so are perhaps no longer just Argentina.

The other main parties in this case also wanted the court to throw the Duane Morris amicus brief out — some for procedural reasons a bit like NML’s (the Exchange Bondholder Group). Others, however, lost no time linking it back to NML’s case.

This was Fintech for instance:

Appellees urge this Court to confirm a remedy which will make them whole, but leave the other Original Bondholders (including Fintech) holding the same exact rights at the whim of the future ability of the Republic to pay…

Which then quickly turned into a warning to the courts that they would soon be litigating holdouts versus holdouts:

To the extent Appellees’ position on appeal is correct, each of the Original Bondholders that stand in Appellees’ shoes and would be entitled to assert the same arguments and to obtain the same relief…Chaos would ensue as Original Bondholders around the world stake competing claims on the Republic’s limited resources. Moreover, other Original Bondholders could seek – and likely obtain – injunctive relief(possibly on a class-wide basis) to preclude Appellees and other Original Bondholders from obtaining recovery before the parties seeking an injunction are able to do so.

This is perhaps why the court’s denial of the Duane Morris request just to file as amici isn’t the end of this story.

The Duane Morris holders aren’t even the first judgment creditors of the FAA bonds to imply that they could be looking at bringing pari passu claims after an NML victory: that would be EM Ltd. (It “believes that the Equal Treatment Provision applies with identical force in the post-judgment context…”)

Fintech also suggest a vehicle for these holders to do that on the back of a ratable payment to the plaintiffs in this case — something called mandatory class actions, an idea considered for sovereign debt workouts by Buchheit and Gulati in 2002, and which would get the courts to review full payment to one creditor if it might “substantially impair or impede” other creditors getting theirs. It comes from the slightly decrepit hinterland of bankruptcy law.

Which is of course the point.

The US courts in the pari passu saga initially swore off anything like sovereign bankruptcy for Argentina, having ruled on the actual case as a “simple question of contract interpretation.” (Ever since then we’ve only been talking remedies.) The Second Circuit seemed to move away from that a bit nevertheless, when it came to Argentina ordering the Republic’s alternative idea for repaying holdouts rather than throwing the book at it straight away.

Even so, the court’s final ruling (when it comes) surely won’t be paying Argentina’s idea much shrift there.

But holdouts vs holdouts really can be a thing under the expected final ruling – assuming the Duane Morris amicus episode isn’t the end of it – then isn’t a bastardised version of sovereign bankruptcy coming our way in any case?

Keine Kommentare:

Kommentar veröffentlichen