rolf´s argentinien-blog

Gesamtzahl der Seitenaufrufe

Freitag, 16. August 2019

Mittwoch, 14. August 2019

nächster default...

Dienstag, 13. August 2019

With the debt ratio having exploded over the past two years, and the sovereign now even further away from regaining market access, we think there’s a good chance that the IMF asks for a restructuring,” Capital Economics’ economists wrote in a research note. “This could come as a condition of the next loan tranche of $7.6 billion, due on 15th September.”

Argentina’s presidential front-runner Alberto Fernandez criticized his opponent, incumbent Mauricio Macri, for increasing short-term debt to unsustainable levels, although he said he doesn’t want to default on the country’s obligations.

One day after a primary election victory that put him on track to win the presidency in the October election, Fernandez said the country needs to change its economic model, without offering a clear alternative. The agribusiness sector isn’t selling enough grains to bring in enough dollars, he said.

Alberto Fernandez

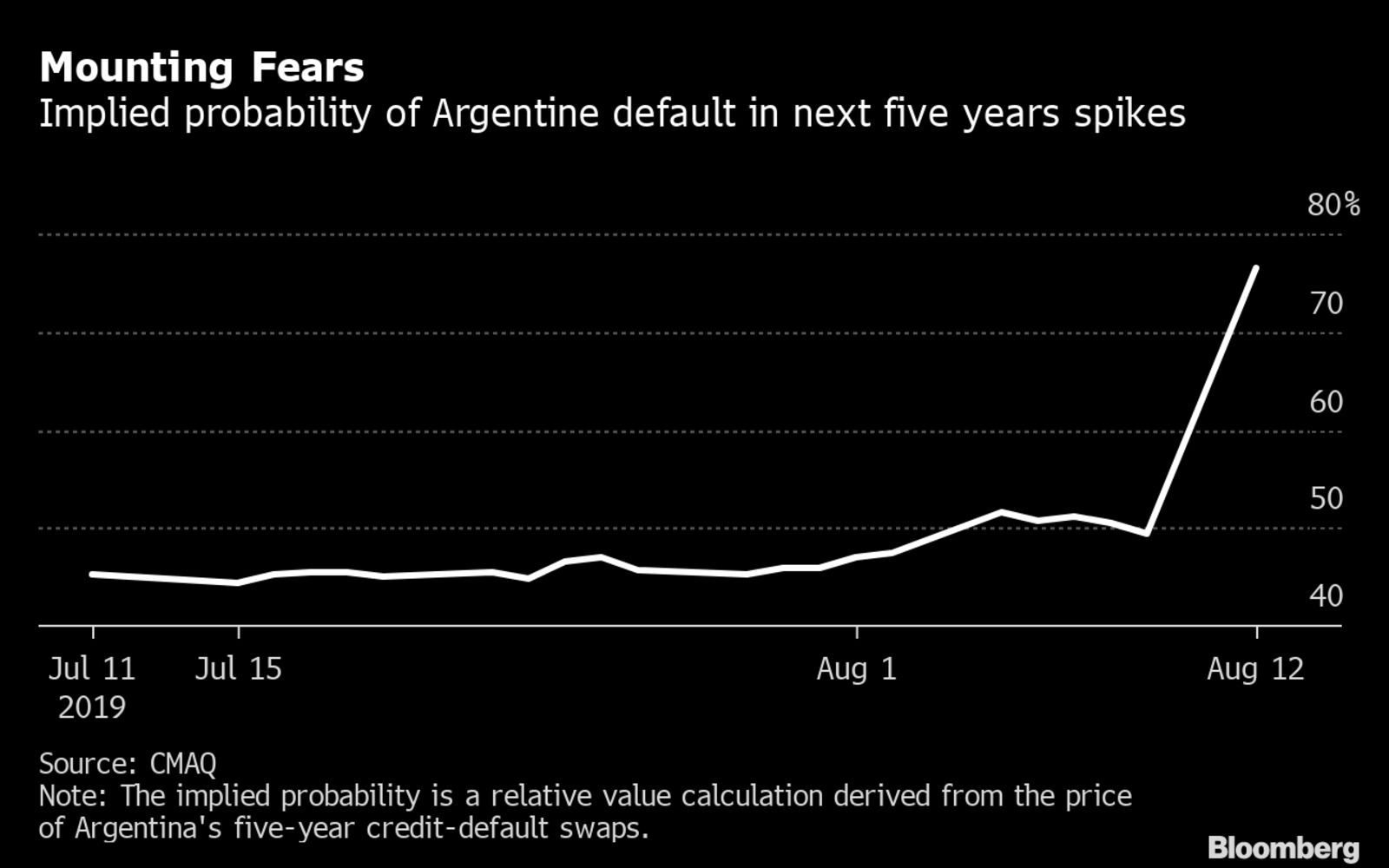

“Nobody believes Macri can pay back the debt,” Fernandez said in an interview with a local TV channel in Buenos Aires on Monday. “Bond prices indicate investors see the country in default.”

Argentina’s bonds and currency tumbled for a second day on Tuesday as investors feared Fernandez may bring back the populist policies once implemented by his running mate, former President Cristina Kirchner. Fernandez has yet to detail his economic policies, but has already said he will seek to renegotiate the terms of an agreement with the International Monetary Fund.

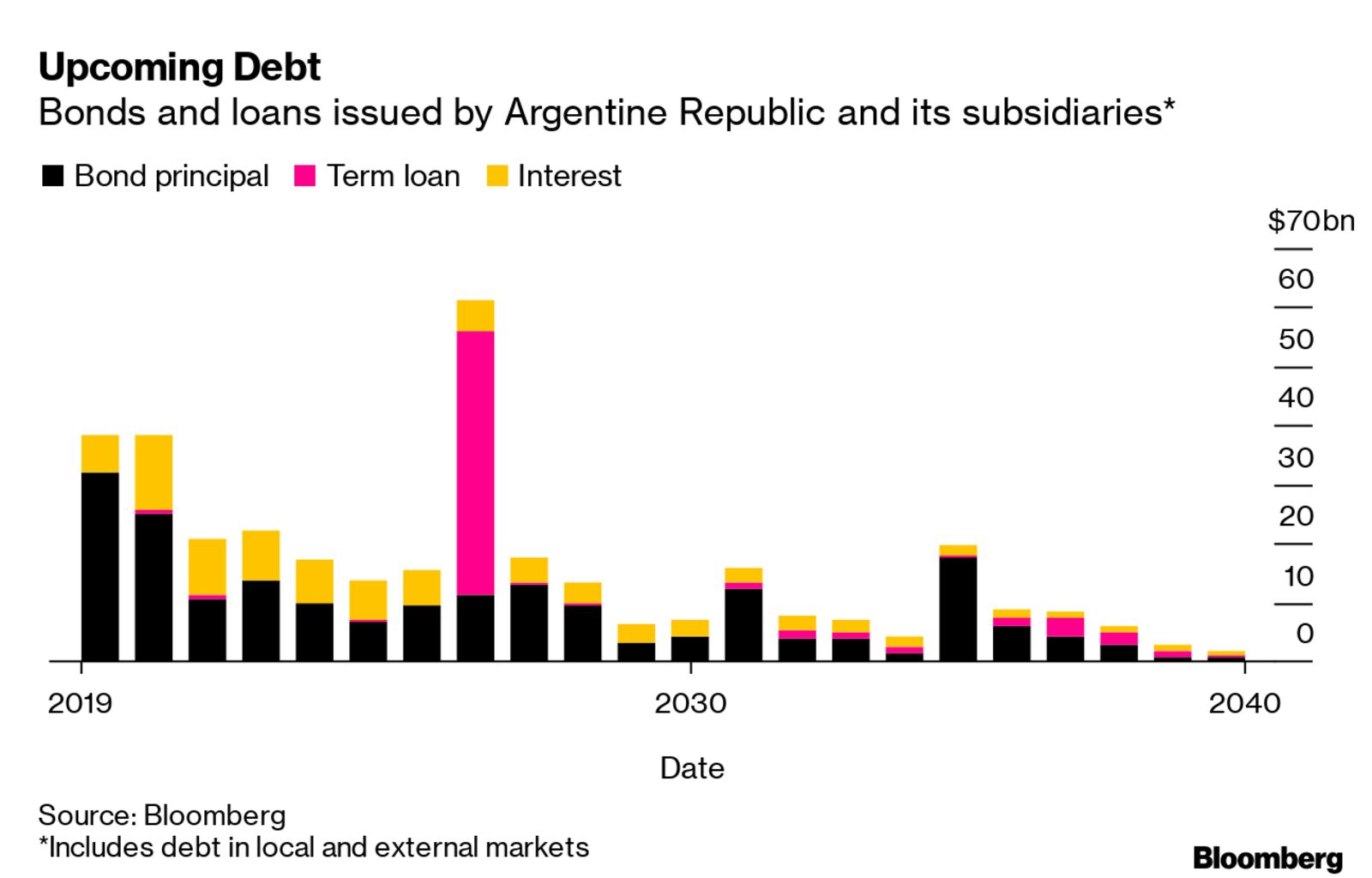

In the interview, Fernandez didn’t say how he would avoid restructuring the country’s debt. Argentina faces large repayments of foreign currency-denominated bonds in the second quarter of 2020. But it could be forced to restructure its debt even earlier -- perhaps before the next disbursement of IMF money scheduled for Sept. 15, according to Capital Economics.

“With the debt ratio having exploded over the past two years, and the sovereign now even further away from regaining market access, we think there’s a good chance that the IMF asks for a restructuring,” Capital Economics’ economists wrote in a research note. “This could come as a condition of the next loan tranche of $7.6 billion, due on 15th September.”

The IMF declined to comment.

Blame Game

Fernandez mostly used the interview to lay blame on Macri for the market rout, in a similar strategy adopted by the president during a news conference a few hours earlier. As they pointed fingers at each other, Argentine markets are likely to continue in a downward spiral.

“Macri didn’t understand anything,” Fernandez said in the interview. “It wasn’t a bad election, it was a terrible government. He deserved the punishment of the people.”

With the possibility of a more protectionist government taking power in December, Argentina’s efforts to regain the trust of international markets were quickly unraveling.

Expected to trail his opponent by just a few points, Macri was instead pummeled at the polls Sunday, with voters giving Fernandez a 15-point lead. The sudden shift in voter sentiment shocked foreign investors and Argentines alike, who have suffered through years of high inflation, economic malaise and political division.

When asked about the peso’s 15% drop on Monday, Fernandez said the currency “wasn’t too far from fair value” and that it should stop weakening. “We can agree it was a large drop,” he said.

The Argentine currency continued its sell off on Tuesday, weakening an additional 6%.

“Macri only wooed hot money, carry traders and speculators,” Fernandez said, adding there were lines of communication open with the leader. “He is the only responsible person for the hardship Argentina is going through.”

(Adds analyst comment in fifth paragraph.)

Eingestellt von rolf j. koch

Dienstag, 13. August 2019

Bloomberg

Argentina’s sovereign century bonds tumbled by the most since they were sold in June 2017 after President Mauricio Macri unexpectedly lost a primary vote in a landslide, foreshadowing his potential defeat in October’s presidential election and a possible return to the policies of his predecessor, Cristina Kirchner. The notes reached a record low, taking the yield to more than 12.2%.

Argentina’s sovereign century bonds tumbled by the most since they were sold in June 2017 after President Mauricio Macri unexpectedly lost a primary vote in a landslide, foreshadowing his potential defeat in October’s presidential election and a possible return to the policies of his predecessor, Cristina Kirchner. The notes reached a record low, taking the yield to more than 12.2%.

Eingestellt von rolf j. k

Donnerstag, 8. August 2019

ich glaub ich sollte mal mein ArgentinienBlog wiederbeleben

Hallo,

vorgestern veröffentlichte der BFH den Beschluss VIII R 7/16.

Danach hätten die Ausschüttungen auf die Argy-BIP-Kicker nicht mit Zinsabschlag- bzw. Abgeltungsteuer besteuert werden dürfen, wenn man diese schon vor dem 15.03.2007 im Depot hatte. Dies resultiert aus einer komplizierten Übergangsvorschrift in dem inzwischen gestrichenen § 52a EStG.

Da ich keinen Einspruch über die Jahre eingelegt hatte, beträgt der Schaden bei mir einige tausend Euro. Die angefügte Vorgabe von WM Datenservice war mithin falsch.

Frage an Rolf: Hatte dein Steuerberater das auf dem Schirm?

Gruß

Sonntag, 7. Oktober 2018

der sehr breit aufgestellte ISHARES J.P. MORGAN $ EMERGING MARKETS BOND UCITS ETF - USD DIS ETF mit ca 15% Verlust....geschuldet dem Anstieg der US-Zinsen (10y treasury)

Samstag, 6. Oktober 2018

Samstag, 20. Januar 2018

Abonnieren

Posts (Atom)